India’s Li-ion battery demand will grow from the current stage of 3 GWh to 20 GWh by 2026 and 70 GWh by 2030. This will need over $10 billion to boost cell manufacturing and raw material refining to serve the local demand according to a report by Arthur D little. Titled “E-Mobility: Cell Manufacturing in India”, the report says that over 70 percent of the imports were from China and Hong Kong and subsequent actions were needed to reduce the dependency.

PrathmeshChoudhary, one of the lead authors of the report while speaking to Business Standard said that “unless and until we get control of the entire supply chain from the mines to the refining, we can’t achieve an inventory”. He said India has to acquire the mines in resource rich countries to maintain its supply like China.

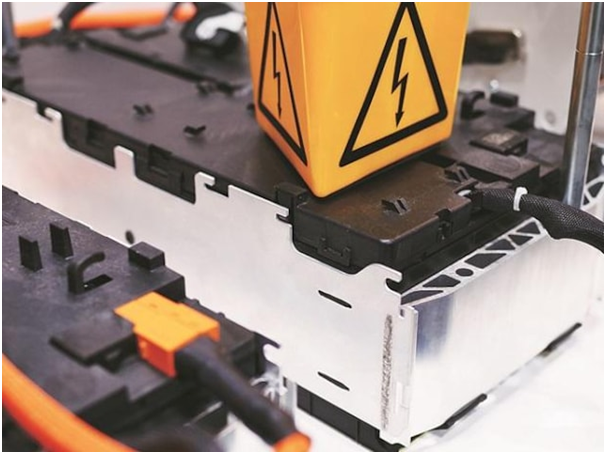

While EV cells are the most critical part of the e-mobility value chain, the Indian EV industry suffers from overdependence on imports, limited local manufacturing, finite access to raw materials, and refining capacities. Large investments in R&D, supportive government policies, foreign direct investment inflows, and aggressive acquisition of raw material resources across geographies can help India achieve self-reliance in Li-ion batteries.

The report further states that to thrive, Indian battery players should invest in collaborative R&D in advanced cell chemistries like sodium-ion, metal-air and designs that are safer, sustainable and economical in the Indian context and could be commercialized at a large scale. Global partnership, joint ventures and acquisitions can further boost capabilities and gain a robust talent edge.

Prathmesh also said that the FAME subsidy for EVs is not feasible for the long term. According to the report, although the government’s efforts such as FAME I & II policies and an increase in OEMs, traditional players, new-age start-ups venturing into battery manufacturing are gaining traction, they may not be enough to cater to the growing demand. It is necessary for Indian players to aspire for superior quality and environmental standards to gain eminent brand reputation, which will help India become self-sufficient in cells and position it as a global export hub.

Dr Andreas Schlosser, Partner, Global Head of Automotive, Germany said that India had a window of opportunity for the next 5-10 years to move in that direction before it became too late.